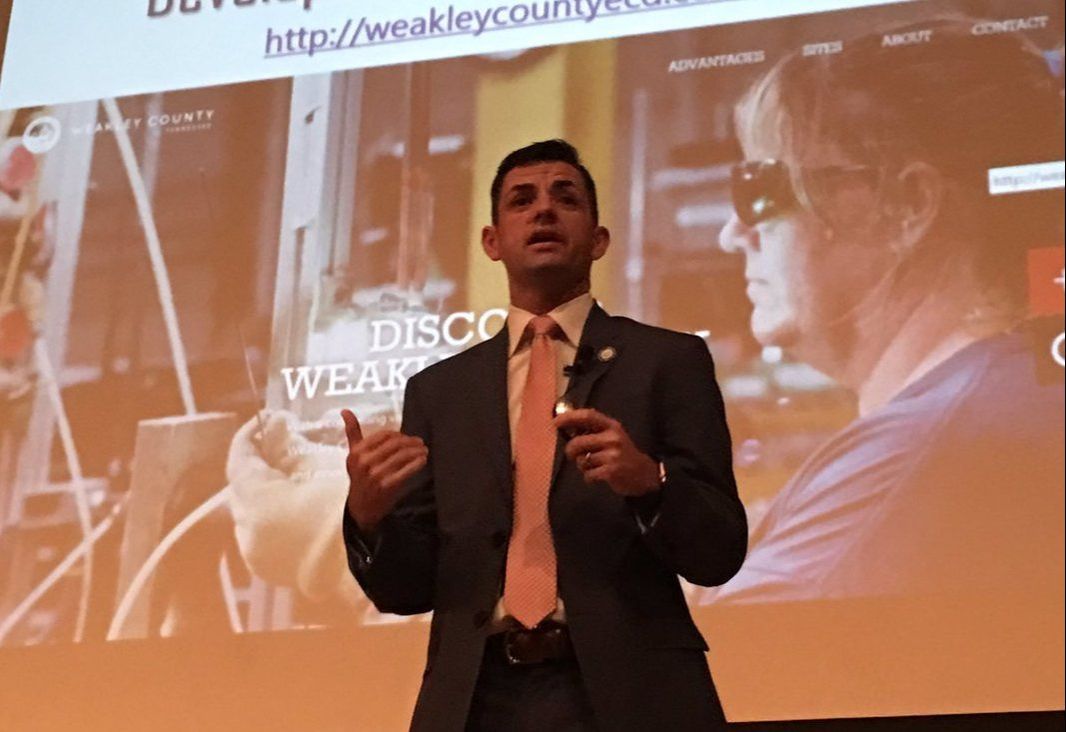

you are finally home in weakley county, tennessee.

Inviting and welcoming communities. Unique natural resources. Advanced educational opportunities. Relaxing, residential lifestyle in a great location. Award-winning schools. Industry-ready availability. A growing and increasingly educated workforce. Scenic, country landscape. A powerful combination of workforce and education, location and infrastructure, industries, and quality of life makes Weakley County, Tennessee, the perfect place to live, work, play, and start a family.

right now, in #weakleycountytn

COMMITTEES AND COMMISSIONMeeting notices, agenda, minutes, and resolutions for Weakley County's Commission and subcommittees.

|

NEWS and moreGet the low down on what's new in Weakley County: press releases, media, and more - it's all here.

|

weakley county bids and financeBids, RFPs, budgeting, county procurement and purchasing policies,

all in one spot for your convenience. |

take our ada plan surveyWeakley County is conducting an Americans with Disabilities Act [ADA] transition plan and we need your help. The purpose of the plan is to identify barriers that make it difficult for people with disabilities to access services, participate, and navigate our facilities comfortably.

Take our survey! |

GET informed

what's happening, weakley county?

check our other calendars of events.

Contact Us

Need information? Contact us below and we will

be in touch as soon as possible.

be in touch as soon as possible.

|

|